Home Tax Deductions 2025. The income tax rates and personal allowances in singapore are updated annually with new tax tables published for. Tax deductions for expenses needed to work from home are only available to taxpayers who itemize their deductions.

For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly). Know what’s deductible after buying that first home, sweet home.

Knowing which deductions or credits to claim can be challenging, so we created this handy list of 53 tax deductions and tax credits you can take in 2025.

The income tax rates and personal allowances in singapore are updated annually with new tax tables published for.

![The Master List of All Types of Tax Deductions [INFOGRAPHIC] Business](https://i.pinimg.com/originals/e2/0f/81/e20f81a96f10e2dc77a5e25a448ba22c.jpg)

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, In this article, we’ll reveal the eligible expenses and provide. Deduct home office expenses if you.

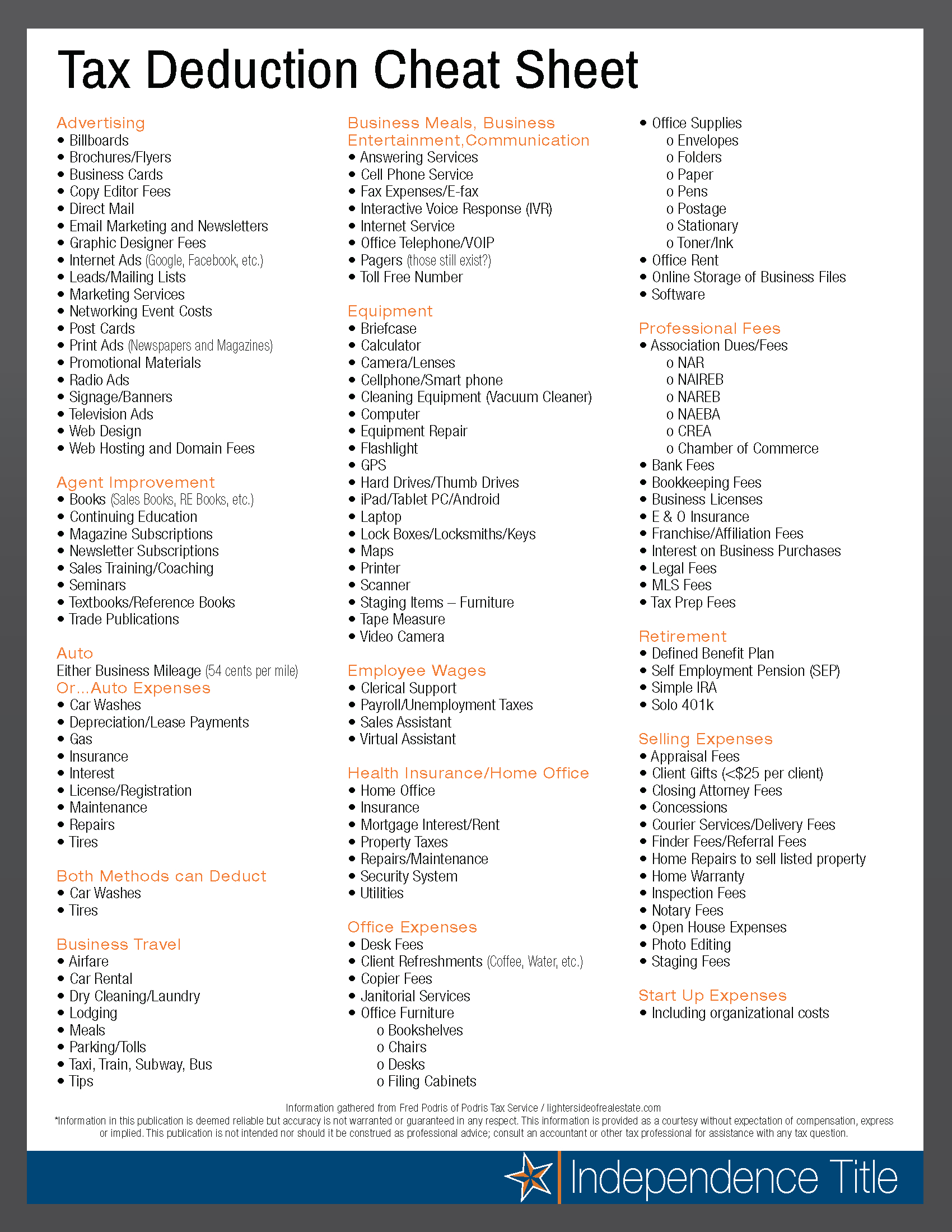

The Master List of All Types of Tax Deductions [INFOGRAPHIC] Business, Find out how to pay less tax! Knowing which deductions or credits to claim can be challenging, so we created this handy list of 53 tax deductions and tax credits you can take in 2025.

Tax Deductions Cheatsheet Etsy, If the sum of the deductions you qualify for is more than the standard deduction, then itemize to reduce your tax bill. Deduct home office expenses if you.

Tax Deduction Cheat Sheet For Real Estate Agents —, Here are the tax deductions for. If you work from home, you may be able to claim a tax deduction for home office expenses.

Tax Deductions for Homeowners Team Amber Anderson Pacific Sothebys, Homeowners can potentially qualify for an energy efficiency home improvement credit of up to $3,200 for. By being a mother or signing up for a course to upskill, you are entitled to relief schemes that can help to subtract your taxable income by up to s$80,000.

Benefits of Owning A Home Tax Deductions for Homeowners, Can you claim work from home tax deductions? Deduct home office expenses if you.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Knowing which deductions or credits to claim can be challenging, so we created this handy list of 53 tax deductions and tax credits you can take in 2025. Taxpayers can take advantage of numerous tax deductions, also known as tax.

17 Big Tax Deductions (Write Offs) for Businesses Bench Accounting, It’s important to understand which expenses you can deduct in 2025 and how to calculate the deduction accurately. Know what’s deductible after buying that first home, sweet home.

Homeowner Tips Tax Deduction Homeowner Savings, Check out this comprehensive guide on section 80 deductions: Taxpayers can take advantage of numerous tax deductions, also known as tax.

The IRS Just Announced 2025 Tax Changes!, Who can claim tax deductions when working from home? If you made a qualifying home improvement in 2025, you may be able to recoup up to 30% of the cost through the energy efficient home improvement credit.